A PGDM in Banking & Financial Services equips you with core banking skills, financial analysis expertise, risk management capabilities, and real-world financial services knowledge required to build a strong career in banking, finance, and allied sectors.

What Skills Does a PGDM in Banking & Financial Services Really Build?

A PGDM in Banking & Financial Services is designed to bridge the gap between academic finance knowledge and real industry requirements. Unlike generic management programs, this specialized financial services PGDM focuses on practical, job-ready skills demanded by banks, NBFCs, fintech firms, and financial institutions.

From understanding how money moves in the economy to managing financial risks and investments, the program develops a strong foundation that supports long-term career growth.

How Does Financial Analysis Skill Shape Your Finance Career?

Financial analysis is one of the most critical skills gained during a PGDM in Banking & Financial Services. It helps professionals evaluate the financial health of organizations and make data-backed decisions.

You learn how to:

- Analyze balance sheets, income statements, and cash flow statements

- Interpret financial ratios and performance indicators

- Forecast revenues, costs, and profitability

- Support strategic business and lending decisions

These skills are essential for roles such as financial analyst, credit analyst, relationship manager, and corporate banker. Strong analytical ability also improves decision-making accuracy in high-stakes financial environments.

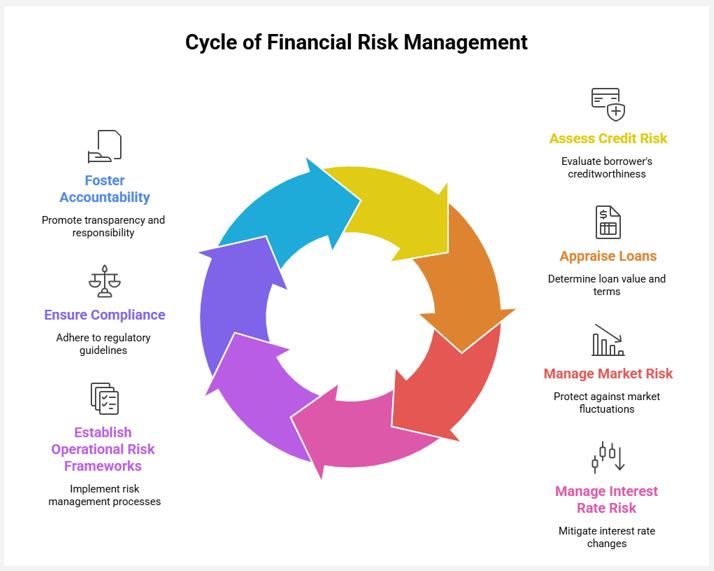

Why Is Risk Management a Core Banking Skill Today?

Risk management has become a central function in modern banking and financial services. With regulatory pressure and market volatility increasing, organizations require professionals who can identify and mitigate risks effectively.

During the program, you gain exposure to:

- Credit risk assessment and loan appraisal

- Market risk and interest rate risk management

- Operational and compliance risk frameworks

- Regulatory guidelines and risk governance

These banking skills are especially valuable for careers in risk management, compliance, internal audit, and credit control across banks and financial institutions.

How Does the Program Build Investment Strategy Expertise?

Investment knowledge is no longer limited to wealth managers or fund managers. Even banking professionals need to understand investment products and strategies to serve clients better.

A PGDM in Banking & Financial Services develops skills related to:

- Equity, debt, and mutual fund analysis

- Portfolio management basics

- Investment planning and asset allocation

- Understanding market behavior and economic indicators

This skill set opens opportunities in investment advisory, wealth management, private banking, and financial planning roles.

What Banking Operations Skills Will You Gain?

Understanding banking operations is essential for anyone aiming to work in core banking roles. The program offers practical exposure to how banks function internally.

You learn about:

- Retail and corporate banking operations

- Loan processing and documentation

- Treasury and clearing operations

- Banking technology and digital banking systems

These operational banking skills ensure that you are not just conceptually strong but also operationally efficient, making you industry-ready from day one.

How Does the Course Improve Regulatory & Compliance Knowledge?

The financial services industry operates under strict regulatory frameworks. A solid understanding of compliance norms is critical for career stability and growth.

The program helps you understand:

- RBI guidelines and banking regulations

- KYC, AML, and compliance standards

- Financial reporting norms

- Ethical practices in financial services

This knowledge is highly valued by employers and is particularly useful for roles in compliance management, audit, and regulatory affairs.

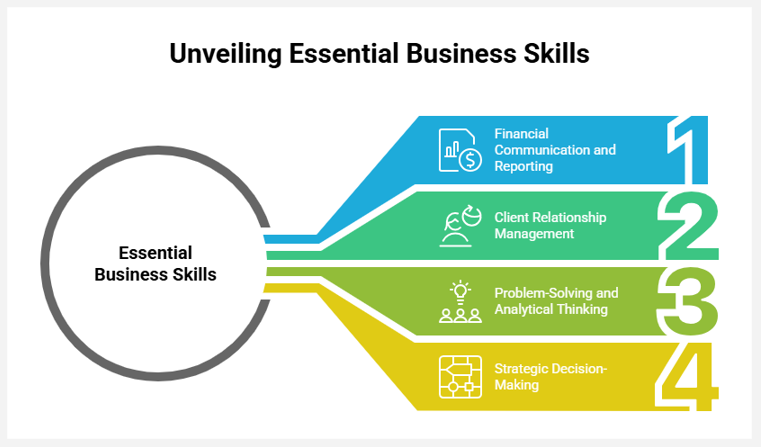

What Soft Skills Are Developed Alongside Technical Banking Skills?

Apart from technical expertise, the program focuses on professional and managerial skills required in finance roles.

Key soft skills developed include:

- Financial communication and reporting

- Client relationship management

- Problem-solving and analytical thinking

- Strategic decision-making

These skills enhance leadership potential and prepare professionals for senior and managerial roles in the financial sector.

How Does a Financial Services PGDM Help Working Professionals?

For working professionals, a financial services PGDM helps upgrade skills without disrupting career continuity. It provides structured knowledge, practical insights, and industry exposure that supports career transitions or promotions.

Professionals gain clarity in:

- Banking domain specialization

- Strategic financial decision-making

- Managing complex financial portfolios

- Aligning financial goals with business strategy

This makes the program ideal for professionals aiming for mid-level to senior roles.

Why Choose MITSDE for PGDM Banking & Financial Services?

MITSDE offers a learner-focused PGDM in Banking & Financial Services designed for both fresh graduates and working professionals.

Key reasons to choose MITSDE include:

- Industry-relevant curriculum aligned with current banking trends

- Flexible online learning model

- Focus on practical application and case-based learning

- Experienced faculty with strong industry exposure

- Career-oriented approach for long-term growth

MITSDE ensures that students gain real-world banking skills that are directly applicable across financial services roles.

Conclusion

A PGDM in Banking & Financial Services is more than a qualification—it is a career-building investment. From financial analysis and risk management to investment strategies and banking operations, the program equips you with in-demand skills required by today’s financial industry. With the right institute like MITSDE, you gain both knowledge and confidence to grow in the competitive banking and finance domain.

Frequently Asked Questions (FAQs)

1. What are the key skills gained in PGDM Banking & Financial Services?

Ans. Financial analysis, risk management, investment strategies, and banking operations.

2. Is a financial services PGDM suitable for working professionals?

Ans. Yes, it helps professionals upgrade skills and grow into higher roles.

3. Are banking skills relevant outside traditional banks?

Ans. Yes, they are valuable in NBFCs, fintech firms, and financial consultancies.

4. Does the course include practical industry exposure?

Ans. Yes, through case studies, real-world examples, and applied learning.

5. Can finance graduates benefit from this PGDM?

Ans. Absolutely, it enhances domain depth and employability.

6. Is regulatory knowledge part of the curriculum?

Ans. Yes, compliance, RBI norms, and ethical practices are covered.

7. Why is MITSDE a good choice for this PGDM?

Ans. MITSDE offers flexible learning with industry-aligned curriculum and expert faculty.

8. What career roles does this program support?

Ans. Roles in banking operations, risk management, financial analysis, and investment advisory.