The finance sector is no longer just about ledgers, balance sheets, and traditional banking. It is now driven by rapid technological advancements and is undergoing a major shift. From FinTech and blockchain to algorithmic trading and big data analytics, modern financial jobs require more than just a basic set of skills. It is time to upskill and learn new skills to make your mark in the job market!

To stay relevant and competitive, continuous learning is essential. This is where specialised credentials can help! Whether you are an aspiring analyst or a seasoned manager, an online finance certification can be the perfect way to propel your career to new heights. Read this comprehensive guide to learn how!

What Are Online Finance Certifications?

Unlike traditional three-year degrees, online finance certifications are focused, short-to-medium-term courses designed to impart specific skills. They are known to zoom in on technical competencies and focus on specific tools, such as Tableau or Python for Finance. These programmes are flexible and designed for the modern workforce. It allows professionals to upskill without quitting their jobs, making high-level education accessible to those who cannot commit to full-time campus study.

Why Pursue Online Finance Certifications?

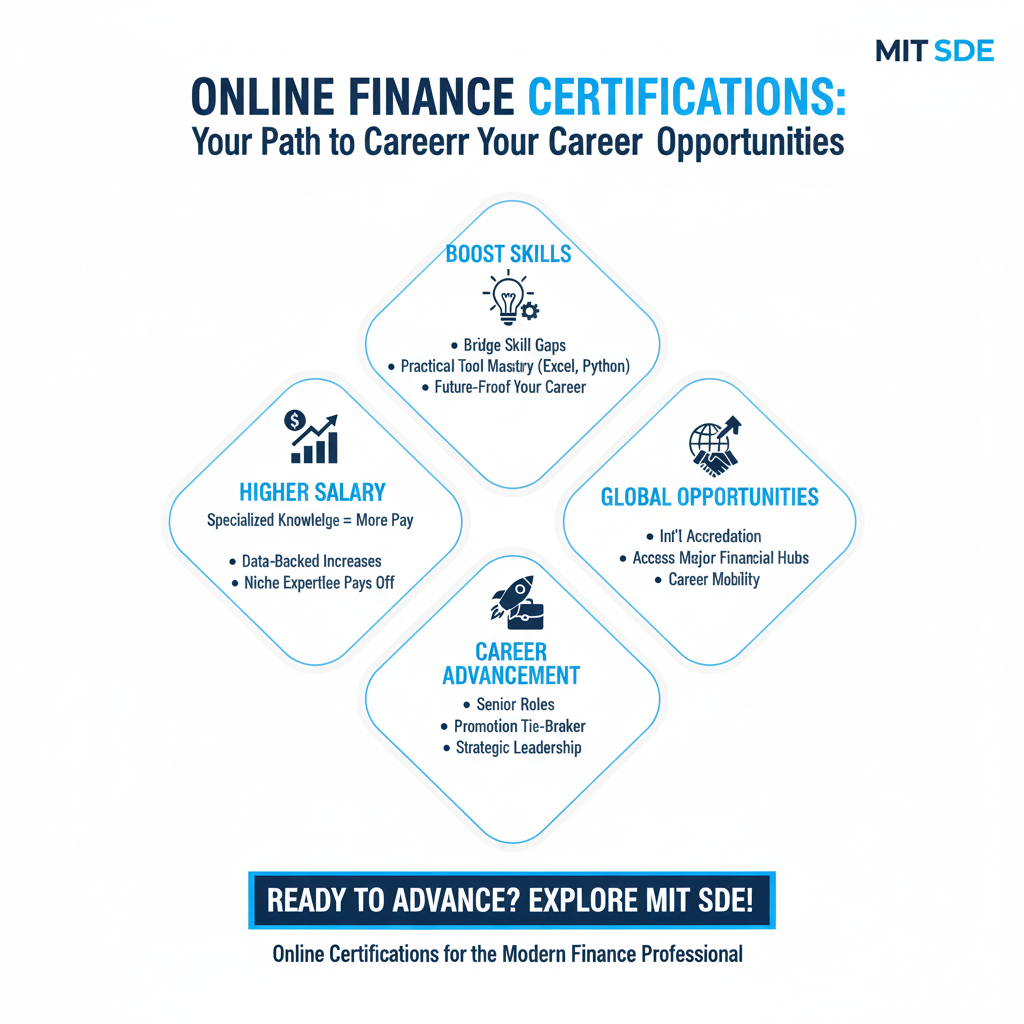

The decision to pursue additional qualifications often comes down to how effective they are. Here is why you should consider pursuing an online finance certification –

- Bridging Skill Gaps – The gap between academic theory and industry practice is widening. Certifications bridge this divide by teaching current trends and future-proofing your career.

- Practical Tool Mastery Online courses often focus heavily on practical application, teaching you how to build complex financial models in Excel, visualise data in Power BI, or utilise SAP.

- Specialisation Without Pausing Your Career – You do not need to take a break from your job to change your career trajectory. You can master a niche during your evenings and weekends and advance your career easily.

Top Online Finance Certifications to Consider

When mapping out your learning path, it is essential to look at credentials that hold weight in the market. While many professionals aspire to a full Online MBA in Finance, stacking that degree with specific certifications creates a formidable profile. Here are the top ones to consider –

- Financial Modelling and Valuation – Essential for equity research and investment banking roles.

- FinTech and Blockchain – Perfect for those looking to enter the disruptive side of banking.

- Data Analytics for Finance – A must-have for modern financial planning and analysis (FP&A).

- Investment Banking Certification – A rigorous dive into mergers, acquisitions, and capital raising.

How These Certifications Boost Career Opportunities

Here are the various ways in which an online Finance certification can help boost your career.

Career Advancement and Senior Roles

Certifications are often the tie-breaker in promotion decisions. They demonstrate to leadership that you possess the strategic discipline required for senior roles. For example, an Online MBA in Finance with certification in risk management signals that you are ready to handle organisational governance.

Higher Salary Potential

Specialised knowledge pays more! Statistics consistently show that certified professionals earn significantly more than their non-certified peers. Also, the more you gain expertise in a niche, the more you stand to improve your career trajectory and pay.

Global Recognition and Mobility

Many finance certifications are recognised globally. This accreditation helps you apply for roles in major financial hubs in India or abroad. It can help you break into cities like London, New York, or Singapore.

How to Choose the Right Certification for You

With many online finance courses with certificates available, making the right choice can be daunting. Here are some factors to consider when choosing –

- Identify Your Goal – Are you aiming for Investment Banking or Risk and Compliance? Your goal dictates your course.

- Check Credibility – Ensure the certification is offered by a reputable institution or endorsed by industry bodies.

- Curriculum Depth – Look for courses that offer hands-on simulations, not just video lectures.

- Placement Support – Go for a course provider that helps you use your new qualification to get a job.

Benefits of Online Learning for Finance Professionals

The digital classroom offers unique advantages for the finance sector. These include the following –

- You can learn at your own pace, revisiting complex quantitative concepts as often as needed.

- Online programmes often provide access to international faculty and a global peer network, offering diverse perspectives on market behaviours that you wouldn’t get in a local classroom.

- It is a cost-effective alternative to fill-time courses. You avoid the overheads of campus life and commutation, focusing your budget strictly on the education itself.

Conclusion

If you are looking to elevate your financial expertise and open doors to global opportunities, it is time to choose an educational partner that understands the industry. MIT School of Distance Education (MITSDE) offers cutting-edge Post Graduate Diplomas in Finance and Financial Services that rival top-tier Online MBA in Finance programmes. Our curriculum is designed to provide the same strategic depth and technical proficiency. So, get in touch with us today to learn more about our online courses and how they can help advance your finance career!