What is a mutual fund?

A mutual fund pools money from lots of investors and invests it in diverse stocks, bonds or other assets. It is professionally managed, so you don’t need to pick investments yourself. Investors buy fund units and their value rises or falls with the fund’s performance. Mutual funds make diversification easier, spreading risk across different investments. They are popular with beginners and experts alike; offering a flexible, transparent and relatively simple way to grow wealth over time.

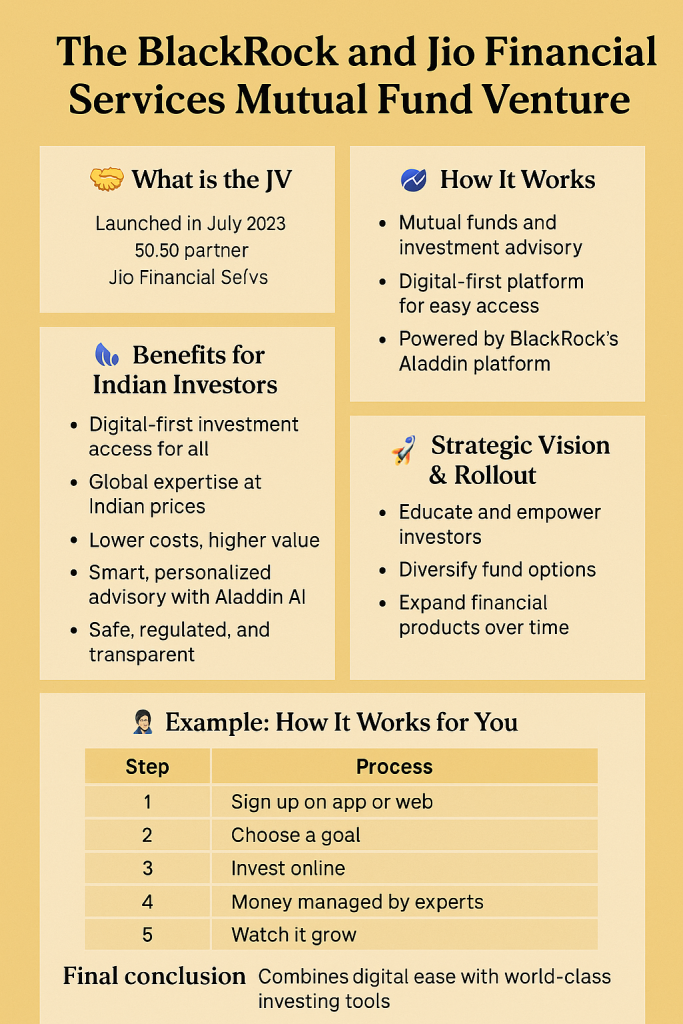

In a landmark collaboration that could redefine the Indian financial services landscape, BlackRock—the world’s largest asset manager—and Jio Financial Services, a subsidiary of Reliance Industries, have joined hands to launch a game-changing mutual fund company in India. This joint venture brings together global investment expertise and deep-rooted digital capabilities to offer accessible, affordable, and intelligent wealth management solutions for every Indian.

In this blog, we explore the inner workings of this partnership, how it benefits investors, and how professional education, like a PG Diploma in Banking and Financial Services from MITSDE, can empower individuals to make the most of these new financial opportunities.

1. The Foundation of the JV: Who Are the Players?

BlackRock: A Global Asset Management Powerhouse

BlackRock Inc. is a financial titan with over $10 trillion in assets under management (AUM). Known for its:

- Sophisticated investment strategies

- Industry-leading risk analytics (via the Aladdin platform)

- Comprehensive portfolio of mutual funds, ETFs, and asset allocation products

BlackRock stands at the forefront of global investment management.

Jio Financial Services: The New Age Indian Finance Leader

Jio Financial Services (JFS), an arm of Reliance Industries, is poised to disrupt the Indian banking and finance sector. Leveraging:

- Massive telecom and retail customer base

- End-to-end digital infrastructure

- Data intelligence for financial inclusion

JFS aims to bring investment and insurance services to India’s underserved rural and semi-urban population.

The Partnership: Jio BlackRock Asset Management

In July 2023, BlackRock and JFS announced a 50:50 joint venture with an initial investment of $150 million. Two entities were formed:

- Jio BlackRock Asset Management

- Jio BlackRock Trustee Pvt. Ltd.

This collaboration will combine BlackRock’s investment excellence with Jio’s digital strength, bringing forth a mutual fund platform that is inclusive, tech-enabled, and future-ready.

2. Step-by-Step Guide: How to Invest in Aladdin Jio BlackRock Mutual Funds

1. Download the App or Visit the Website

- Get the Jio BlackRock Mutual Fund app from Google Play or App Store

- Alternatively, visit the official website for desktop access

2. Complete Digital KYC

- Submit details like Name, PAN, Aadhaar

- OTP verification and video KYC

- Upload a photo and address proof if needed

3. Set Your Investment Goals

Choose from common goals such as:

- Retirement Planning

- Emergency Fund

- Child’s Education

- Wealth Creation

4. Select a Mutual Fund

Pick from:

- Debt Funds (Low Risk)

- Equity Funds (High Growth)

- Hybrid Funds (Balanced)

Use the AI-powered recommendation engine (via BlackRock’s Aladdin) for smart, goal-based fund suggestions.

5. Make Your Investment

- Choose between lump sum or SIP (Systematic Investment Plan)

- Start SIPs from just ₹500/month

- Pay via UPI, debit card, net banking, or auto-debit

6. Track and Manage Investments

- Real-time portfolio dashboard

- Pause, switch, or redeem with a single click

- Get detailed performance reports and risk insights

3. Why This JV Matters: Key Benefits for Indian Investors

1. Democratized Access to Investing

- Accessible via smartphone even in rural India

- Low-entry barrier with affordable SIP options

- Multilingual interfaces to break language barriers

2. Low-Cost, High-Value Investment Options

- Lower distribution and operational costs\

- Reduced expense ratios, benefiting long-term wealth creation

- Transparent pricing with no hidden charges

3. AI-Driven Investment Personalization

- Leverages Aladdin’s AI & ML tools for real-time analysis

- Personalized portfolio suggestions

- Alerts and adjustments based on market trends

4. Safe and Regulated Investment Environment

- SEBI-registered and compliant operations

- Strong governance, audit trails, and global-grade oversight

- Investment handled by certified experts in mutual fund management

5. Promotes Financial Literacy

- Educational content on mutual funds, SIPs, and wealth-building

- Interactive learning tools in regional languages

- Encourages first-time investors to become financially aware

4. Strategic Vision: What Lies Ahead for Jio BlackRock?

Phased Product Rollout

- Phase 1: Launch of debt mutual funds (liquid and overnight)

- Phase 2: Equity and hybrid mutual funds

- Phase 3: Advisory services and wealth management

Deeper Integration with the Jio Ecosystem

- Potential to combine with JioMart, Jio Payments Bank, and MyJio

- Use loyalty points for investment

- Unified experience across telecom, retail, and financial services

Shaping the Future of Retail Investing in India

- Less than 10% of Indians invest in mutual funds—this JV aims to change that

- Encourages long-term savings and financial planning

- Designed for Gen Z, millennials, and tech-savvy Indians

5. Use Case: How Ramesh from Nashik Benefits

Meet Ramesh, a 32-year-old school teacher from Nashik, who has never invested before.

- Download the Jio BlackRock app

- Completes digital KYC in 10 minutes

- Starts SIP of ₹3,000/month for his daughter’s higher education

- Receives AI-guided investment suggestions

- Tracks his investments in real-time

Result: Ramesh is confident, financially literate, and on track to achieve long-term goals.

6. Summary Table: Jio BlackRock Mutual Fund at a Glance

Feature | Benefit |

Digital onboarding | Invest from anywhere, anytime |

AI-powered recommendations | Smarter, goal-based investments |

Low-cost mutual funds | More savings, better long-term returns |

SEBI-regulated | Safe and transparent financial environment |

Real-time tracking | Always stay updated on investment performance |

Regional content | Easy understanding for rural and semi-urban investors |

Wide fund selection | Tailored options for all age groups and income levels |

7. How MITSDE’s PG Diploma in Banking & Financial Services Fits In

As India’s financial sector modernizes, there is an increasing demand for professionals who understand investment products, financial markets, mutual fund operations, and customer-facing services.

Why Choose PGD in Banking and Financial Services from MITSDE?

Learn about modern banking, mutual funds, investment planning, NBFCs, and digital finance ecosystems—skills that are essential for platforms like Jio BlackRock.

Digital Learning Flexibility

Digital Learning Flexibility

Study at your own pace through online modules, designed for working professionals and aspiring financial advisors.

Career Opportunities

Career Opportunities

Graduates can pursue careers in:

- Mutual fund distribution

- Investment advisory

- Wealth management

- Retail banking

- Financial consulting

With platforms like Jio BlackRock gaining prominence, learners can apply knowledge of risk analysis, SIP planning, KYC regulations, and SEBI compliance in live environments.

Help others like Ramesh understand investments and drive financial inclusion through your knowledge.

8. Conclusion: A New Dawn for Indian Investors

The Jio–BlackRock Mutual Fund joint venture is more than a business partnership—it’s a mission to redefine retail investing in India. With its user-first design, global-grade technology, and financial accessibility, the venture opens the gates for millions to participate in structured wealth creation.

Whether you’re a seasoned investor or just starting, digital platforms like this are the future—and understanding how they operate through education (like a PG Diploma in BFSI from MITSDE) gives you a significant edge.

Frequently Asked Questions (FAQs)

1. What is the Jio–BlackRock partnership?

Ans. It’s a joint venture between Jio Financial Services and BlackRock to offer low-cost, tech-driven mutual funds to Indian investors.

2. How will Jio and BlackRock change mutual fund investing in India?

Ans. They aim to simplify investing through AI-powered tools, low fees, and easy digital onboarding, making mutual funds more accessible to the masses.

3. Are Jio–BlackRock mutual funds safe?

Ans. Yes. All funds are SEBI-regulated and follow standard mutual fund compliance and transparency norms.

4. What benefits do investors get from the Jio–BlackRock platform?

Ans. Users get low-cost funds, AI-based recommendations, simple app-based investing, and real-time portfolio tracking.

5. How can beginners invest in Jio–BlackRock mutual funds?

Ans. Download the app, complete digital KYC, choose a fund, and start investing with small SIP or lump-sum amounts.

6. Will Jio–BlackRock reduce mutual fund charges?

Ans. Yes. The venture focuses on low-fee funds to make wealth creation affordable for first-time and long-term investors.