A study of the oldest financial records states that they can be traced back to the Babylonian period, around 3000 B.C.

We have come a long way from the era of gold and copper coins to fiat currency and now digital finance. The finance world is constantly evolving. The Covid-19 pandemic further impacted online transactions & virtual banking facilities.

The Indian financial market is valued at 37.37 trillion (US$ 477.55 billion), making it one of the world’s most robust and vibrant markets. This translates into extensive opportunities in the financial services sector.

As we are halfway through 2023, the financial industry is changing rapidly. In such a scenario, individuals and businesses must prepare themselves for the future.

Here’s a list of emerging trends in finance for 2023:

Fintech Technology-

Financial technology (fintech) improves the delivery of financial services. It uses technology like Artificial intelligence and machine learning to enhance the experience of financial services. The technology makes them easy to use and access. Mobile banking, digital payments, and robo-advisory services are gaining increasing popularity.

Fintech companies use artificial intelligence, blockchain technology, and machine learning to enhance efficiency, security, and accessibility in various financial services.

According to a survey, the Indian Fintech industry will grow at a CAGR of 150%.

Digital Currencies –

According to the World Economic Forum, in the past 30 years, over 600 currencies have disappeared. Cryptocurrencies like Bitcoin and Ethereum have disrupted the traditional financial ecosystem.

In 2023, Governments are planning to accept digital currencies as a form of payment. Central banks worldwide are also exploring the concept of Central Bank Digital Currencies (CBDCs).

Digital currencies have particular positives like borderless payment, free from Government or individual control, and better safety. They also have specific cons, such as a lack of control, volatile nature, and awareness and acceptance.

Sustainable Investing –

Investors prioritise companies with substantial environmental, social, and governance (ESG) practices. This trend promotes positive societal and environmental impact and provides potential financial returns.

Incorporating sustainability into investment strategies or financial planning can help individuals and businesses attract investors and grow their market value.

Open Banking APIs –

Open banking APIs allow customers to securely share their financial information with authorised third-party providers. It enables personalised financial services and enhanced financial Management. They are

Examples of Open Banks are – Unified Payment’s Interface (UPI), Microloan apps like Cred, virtual bookkeeping apps, etc.

According to a survey, in November 2022, Unified Payments Interface (UPI) recorded 7.30 billion transactions worth Rs. 12.11 trillion.

Open banking fosters competition and innovation in the financial industry, empowering individuals with greater control over their financial data and choices.

Cybersecurity and Data Privacy –

Cybersecurity and data privacy are critical concerns as the financial industry becomes more digitalized. With the growing cyber threats, robust security measures are necessary to protect their financial information and transactions. Moreover, regulatory frameworks are essential for smooth functioning.

Individuals must be vigilant and update themselves about the growing threats. Governments and companies must adopt robust security protocols and privacy regulations. It will be beneficial in safeguarding financial assets and maintaining trust.

Digital finance has brought many positive changes to the financial markets. It has impacted many industries and has paved the way for new opportunities. Thus to gain from this new digital wave, it is crucial for one to stay updated with the latest trends.

Any company it individual must embrace emerging trends to be better than the competition and become successful.

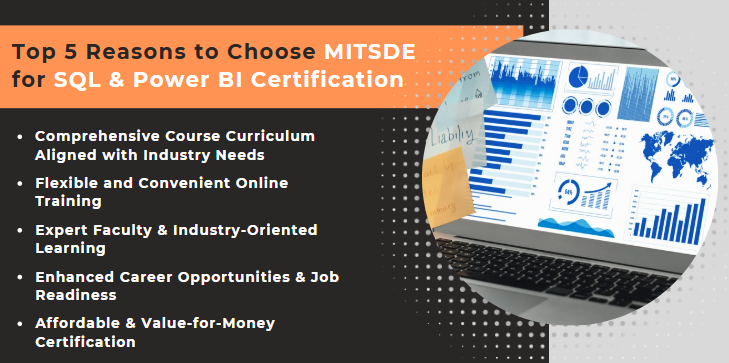

Top distance learning institutes like MIT School of Distance Education (MITSDE) offer a Post Graduate Diploma in Finance Management. The course helps you to make informed financial decisions.

MITSDE is approved by AICTE and offers globally recognised and accepted courses. The PGDM Finance Management is a 21-month course. PGDM Finance course focuses on-

- Essential functions of financial management

- Financial modelling

- Capital structures & financial markets

- Financial reports & International reporting standards

- Fintech and international finance

- Hands-on training in the latest tools and techniques

In addition, MITSDE offers a dedicated team of student success managers to assist you in your academic journey.

The placement cell offers services like resume-building and career-building sessions to help secure a rewarding career.

Lastly, initiatives like MITSDE Labs and Harbour offer a perfect blend of practical hands-on training and psychological counselling.

Thus, MITSDE offers a 360-degree learning approach that guarantees a rewarding career.